Your Partner for Smarter Business Finance

Get the clarity of a smarter process and the confidence of a dedicated finance partner. We analyse the market to find your optimal funding solution, so you can make your next move with certainty.

Finance Solutions for Every Business

Commercial Vehicles

Fast, competitive finance for utes and vans.

Heavy Equipment

Tailored finance for trucks and heavy machinery.

Working

Capital

Access working capital to manage your cash flow.

Low-Doc

Loans

Finance for sole traders with minimal paperwork.

Business Equipment

Finance for your complete business fit & equipment.

Invoice

Finance

Unlock cash from your unpaid invoices sooner.

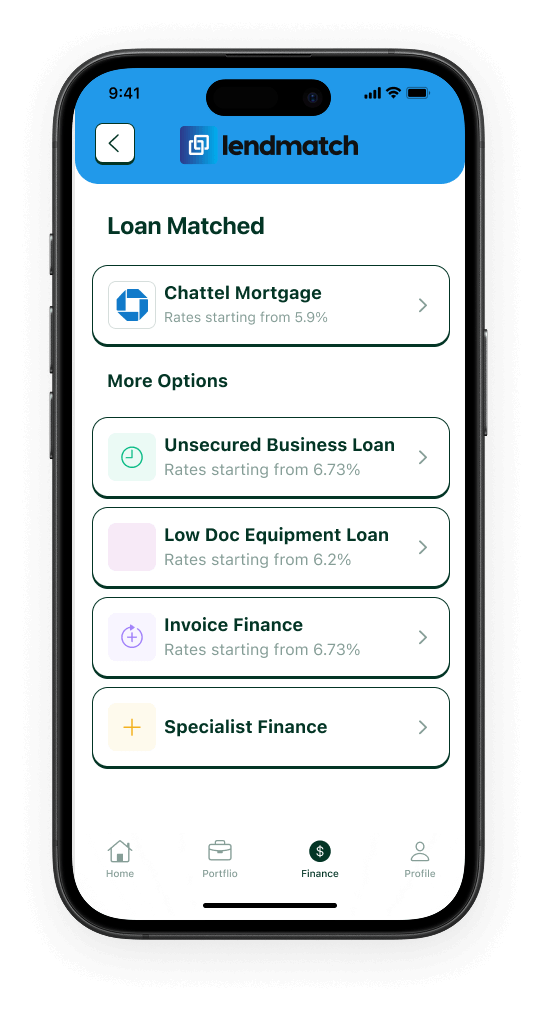

One Application,

A World of Options

Our smart platform streamlines the process, giving you access to over 50 lenders with a single application. We cut down on the paperwork and complexity, letting you compare tailored options and get funded, faster.

Get a Quick QuoteA Trusted Partner, Ready To Help

Every client is paired with a dedicated finance specialist. Backed by a panel of over 50 lenders, we’re here to answer your questions, provide clear, honest advice, and act as your advocate to secure competitive terms tailored to your needs.

Chat with a Specialist

Your Effortless Path to Finance

Ready to Find Your Perfect Finance Match?

Our specialists are ready to understand your unique needs and compare options from over 50 lenders to find the ideal solution. Let's get started today.

Frequently asked questions.

Have a question? We've answered some of the most common ones below. If you can't find your answer here, don't hesitate to get in touch.

Will getting a quote impact my credit score?

No. When you request an initial quote from us, we only perform a 'soft enquiry' which does not leave a mark on your credit file or affect your score. We will always ask for your full consent before proceeding with a formal credit application with a lender.

How quickly can I get approved?

We understand that speed is often critical. While approval times can vary depending on the lender and the complexity of your application, many of our lenders offer decisions within 24 to 48 hours once all required documents are submitted. Our team works proactively to keep the process moving as fast as possible.

Why should I use lendmatch instead of going directly to my bank?

Three key reasons: Choice, Expertise, and Time. Your bank can only offer you its own limited range of products. We give you access to a network of over 50 lenders, allowing us to find a more suitable or competitive option for your specific needs. Our specialists handle the entire process, saving you valuable time and effort.

What documents will I need to apply?

This can vary depending on the lender and loan type. For a simple low-doc loan, your ABN and a few recent bank statements may be all that's required. For other loans, you might need financial statements and tax returns. Your dedicated specialist will provide a simple checklist and guide you on exactly what's needed for your situation.

Get in touch with us.

Have a question about your specific scenario? Send us a message, and our team will get back to you promptly. You can also follow us on social media for the latest updates and financial insights for your business.